💰 DeFiMatrix Tokenomics

DeFiMatrix ($DMX) Tokenomics: An Expert's Perspective on AI-Powered Decentralized Finance

DeFiMatrix ($DMX) represents a significant evolution in decentralized finance (DeFi) by integrating artificial intelligence (AI) into its core token economy. Operating on a fixed supply of 500,000,000 $DMX tokens and ecosystem is architected for sustainable growth and the generation of real yield. The $DMX token functions as the foundational economic and operational primitive of the DeFiMatrix platform. Its utility spans AI strategy execution fees, staking mechanisms, decentralized governance participation, and ecosystem growth incentives. Furthermore, the inclusion of deflationary measures, such as fee-based burning and supply constraints through staking lockups, positions $DMX for long-term value accrual and economic resilience within the broader blockchain landscape.

Token Utility: A Multi-Dimensional Framework

DeFiMatrix's $DMX token transcends conventional utility, establishing a multi-dimensional framework crucial for user engagement, protocol expansion, and financial innovation within the decentralized ecosystem.

1. Core Protocol Functionality

- Transaction & Fee Engine: $DMX serves as the native gas token for transaction fees across various on-chain operations, including swaps, cross-chain bridges, and yield vaults. This design ensures that every DeFi interaction on the platform directly contributes to $DMX demand.

- Collateral Utility: The token can be utilized as collateral within decentralized lending and borrowing protocols integrated into the DeFiMatrix ecosystem. This enhances capital efficiency and provides users with leverage opportunities, a critical component for sophisticated DeFi strategies.

2. AI-Driven Incentives & Access

- AI Strategy Access: Access to advanced AI-powered investment strategies and optimized portfolio management solutions is gated by $DMX fees. This mechanism directly links the token's value to the platform's unique AI capabilities, creating a strong demand driver.

3. Incentive Alignment & Real Yield Distribution

- Yield Pull-Through: A portion of all transaction and bridge fees generated within the ecosystem is redistributed to $DMX stakers. This creates a direct, organic yield mechanism, aligning the interests of token holders with the overall health and activity of the protocol.

- Liquidity Mining Programs: $DMX tokens are strategically deployed to incentivize liquidity provision across decentralized exchanges (DEXs) and facilitate integrations with partner protocols. This boosts network depth, reduces slippage, and enhances cross-chain interoperability.

4. Protocol Security & Operational Roles

- Protocol Security Functions: While DeFiMatrix is not a Proof-of-Stake (PoS) blockchain, certain critical platform operations, particularly cross-chain bridging, incorporate $DMX-backed staking mechanisms. These mechanisms secure network safety and ensure the integrity of cross-chain asset transfers.

Summary of Token Utilities

| Utility Type | Mechanism |

|---|---|

| Transaction Fees | Utilized across swaps, bridges, and vaults |

| Collateral Use | Enables leverage via decentralized borrowing/lending |

| AI Strategy Payments | Grants access to AI-driven portfolio optimization services |

| Governance Rewards | Earned through active participation in DAO governance |

| Fee Redistribution | Transaction and bridge fees shared with $DMX stakers |

| Liquidity Incentives | Used for yield farming and strategic partner integrations |

| Platform Security | Backing for secure cross-chain bridging and risk mitigation mechanisms |

Expert Interpretation: Strategic Implications

This meticulously designed, multi-layered utility framework significantly elevates $DMX's strategic importance within the DeFi landscape:

- Demand-Based Dynamics: The token's intrinsic link to core platform functionalities, such as AI strategy access, borrowing, and cross-chain operations, ensures consistent, organic demand. This contrasts with speculative demand, fostering a more stable and resilient token economy.

- Incentive-Driven Growth: The integration of real yield mechanisms and liquidity incentives reinforces the token's role in securing protocol liquidity and fostering decentralized governance. This long-term capital alignment is crucial for sustainable ecosystem expansion.

- Functional Stickiness: By serving as collateral and a gateway to advanced AI services, $DMX transforms from a mere speculative asset into a high-utility primitive deeply embedded in the protocol's operational fabric. This creates a strong incentive for users to hold and utilize the token.

Technical Architecture

- Token Standard: ERC-20, deployed on the Arbitrum Layer 2 scaling solution. This choice leverages Arbitrum's low transaction costs and high throughput, crucial for a high-frequency DeFi platform.

- Security Features: The protocol incorporates industry best practices, including audited smart contracts, multi-signature (multi-sig) safes for critical operations, and upgradeable modules with time-locks. These features enhance security and provide a controlled upgrade path.

- Multi-Chain Roadmap: Future deployments are planned across major Layer 1 and Layer 2 blockchains, including BNB Chain, Polygon, and Optimism, utilizing secure cross-chain bridging infrastructure. This strategy aims for broad interoperability and accessibility.

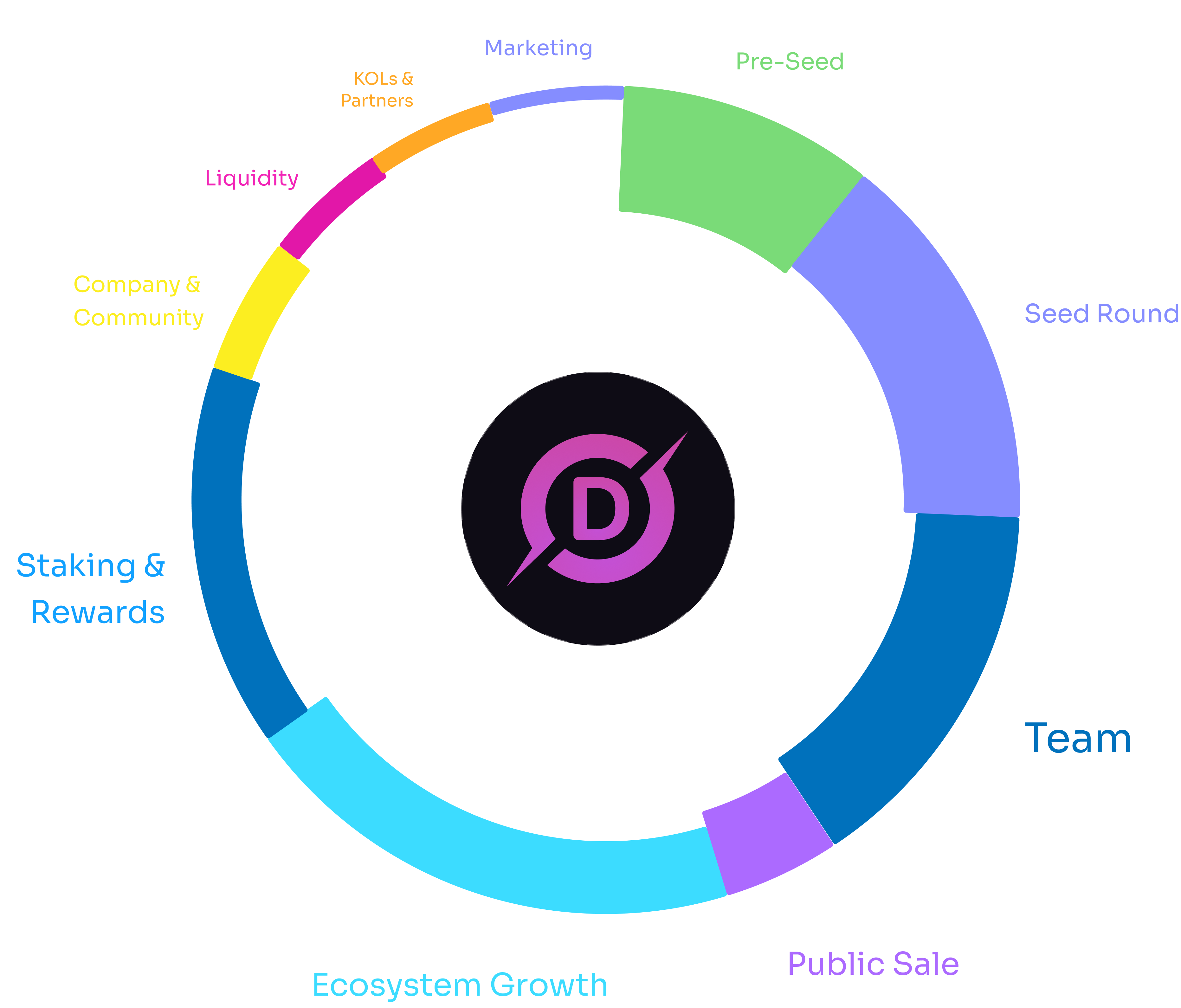

Token Distribution

| Category | % Allocation | Token Amount | Purpose |

|---|---|---|---|

| Pre-Seed | 10.0% | 50,000,000 | Early-stage development capital |

| Seed Round | 15.0% | 75,000,000 | Scaling operations, talent acquisition, strategic growth |

| Team | 15.0% | 75,000,000 | Core team incentives & long-term alignment |

| Public Sale | 5.0% | 25,000,000 | Fair distribution & broad community onboarding |

| Ecosystem Growth | 20.0% | 100,000,000 | Partnerships, integrations, protocol development |

| Staking & Rewards | 15.0% | 75,000,000 | Yield generation, incentive programs, protocol security |

| Company & Community | 5.0% | 25,000,000 | Operational expenses & local community building |

| Liquidity | 5.0% | 25,000,000 | Centralized Exchange (CEX) / Decentralized Exchange (DEX) liquidity provisioning |

| KOLs & Partners | 5.0% | 25,000,000 | Strategic exposure, influencer alignment, ecosystem expansion |

| Marketing | 5.0% | 25,000,000 | User acquisition & brand awareness campaigns |

Monetary Policy

- Supply Cap: A hard cap of 500,000,000 $DMX tokens ensures scarcity and prevents inflationary pressures from uncontrolled supply.

- Burning Mechanism: A portion of all fees generated within the DeFiMatrix ecosystem is programmatically burned, permanently removing $DMX from circulation. This deflationary mechanism enhances token value over time.

- Staking Lockups: Mandatory lockup periods for staked $DMX tokens reduce the circulating supply, further contributing to deflationary pressure and encouraging long-term holding.

- Emission Schedule: A carefully designed linear emission schedule with controlled vesting ensures a gradual release of tokens into the market, mitigating sudden supply shocks and promoting price stability.

Vesting & Cliff Schedule

| Category | TGE Release | Cliff | Vesting |

|---|---|---|---|

| Pre-Seed | 0% | 6 months | 18 months |

| Seed | 0% | 6 months | 18 months |

| Team | 0% | 12 months | 24 months |

| Public Sale | 100% | 0 months | 0 months |

| KOLs | 100% | 0 months | 0 months |

| Liquidity | 50% | 0 months | 6 months |